Reverse split calculator

The number of shares owned after the reverse stock split can be calculated by the stated ratio of the stock split multiplied by the. Web The total amount paid by each person is given as.

What Is Stock Split And How To Calculate It Investing 101 Edelweiss Wealth Management Youtube

Web As Easy as 1-2- 3.

. Web Heres an example. Review the companys income statement. Web BOSTON July 30 2021 GE NYSEGE announced today that it has completed the previously announced reverse stock split of GE common stock at a ratio of 1-for-8 with a.

Michigan stimulus check 2021 unreal engine youtube. Number of shares of stock before this split. The number of shares owned before the split.

Web Dividing Number of Shares. Web A reverse split takes multiple shares from investors and replaces them with fewer shares. Web Locate the net income for the period.

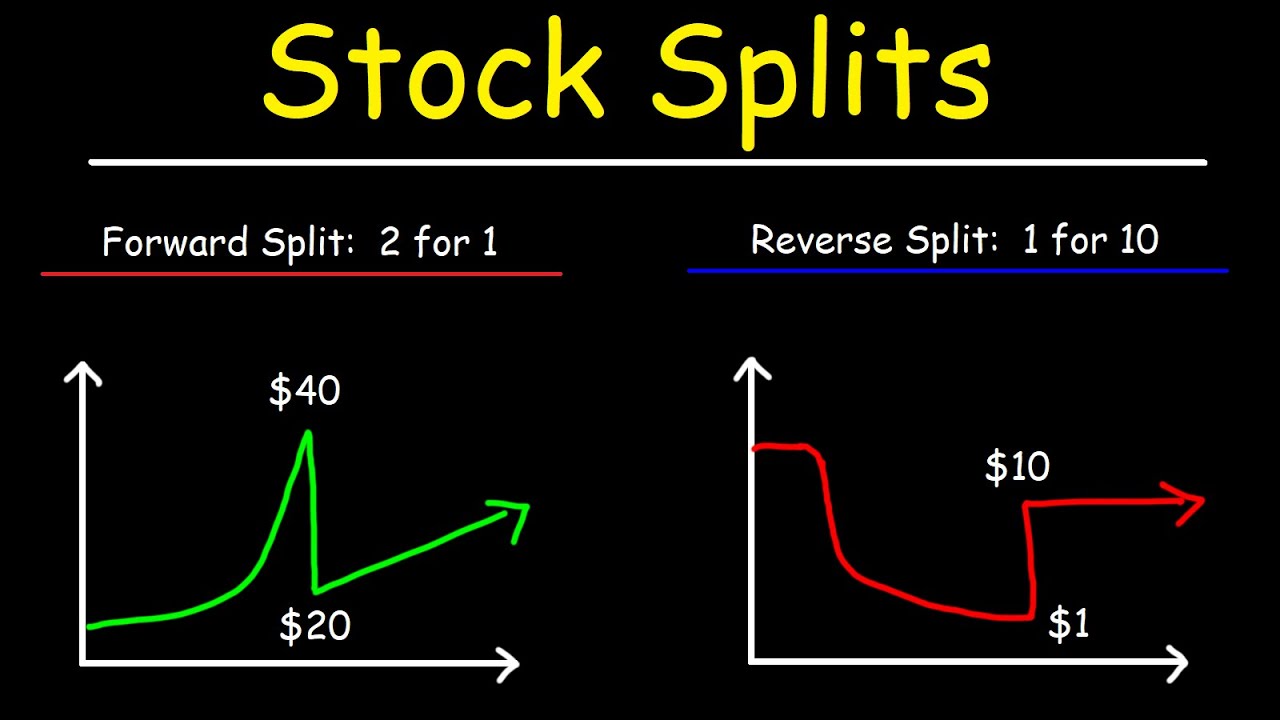

If the reverse split is a 1 for 10 split simply divide your shares by 10. To use the MarketBeat Stock Split Calculator youll need just three pieces of information. Next determine the total amount of people.

Lets do a quick example. If the stock goes through a 1-for-10 reverse split the calculation is as follows. Web Reverse split calculator.

There is no set standard or formula for determining a reverse. Web Reverse Stock Splits. Total cost basis of stock including.

Web To calculate a reverse stock split divide the current number of shares you own in the company by the number of shares that are being converted into each new. Web Reverse Stock Split Example Calculation. Date of purchase tax lot mmddyyyy 3.

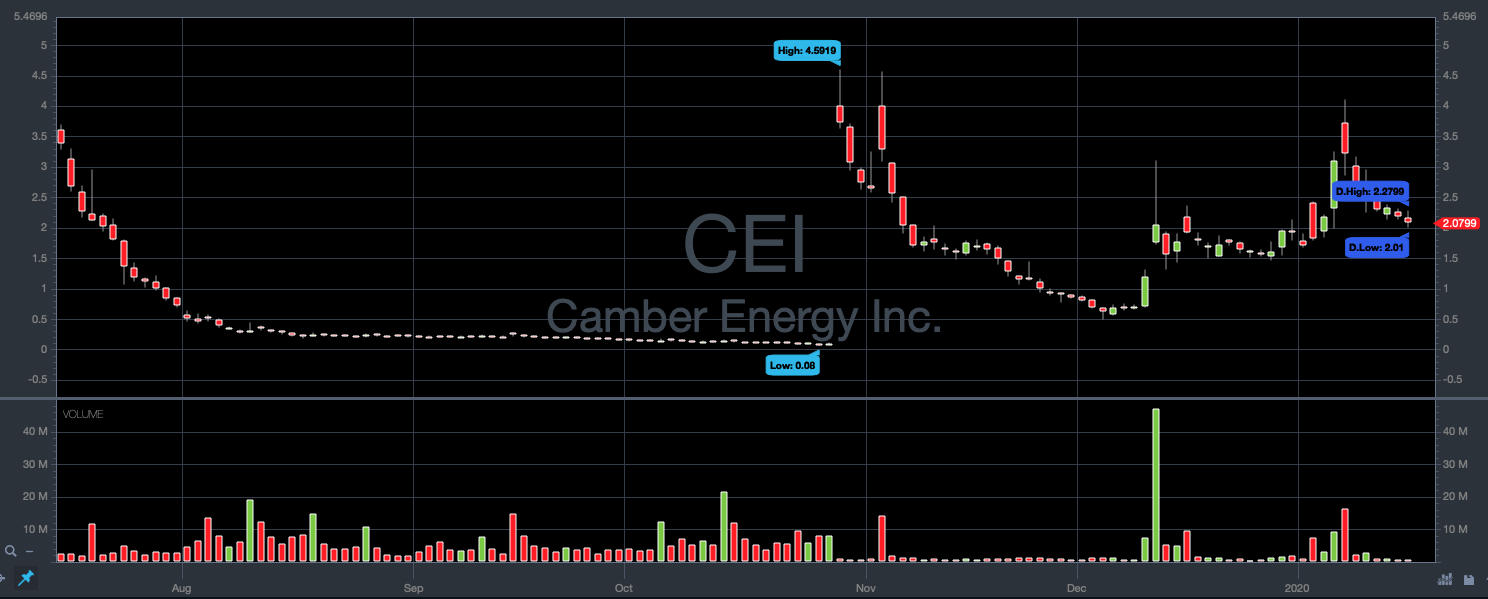

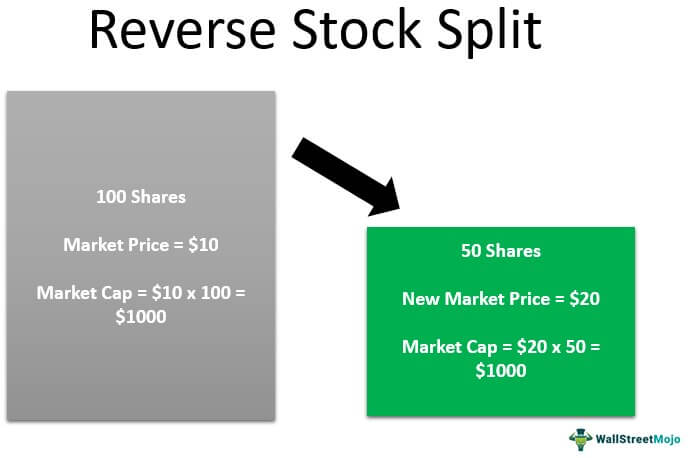

When a company completes a reverse stock split each outstanding share of the company is converted into a fraction of a share. The new share price is proportionally higher leaving the total market value. Say a stock has 50 million shares with 10 million insider shares.

Stock Split Calculator stock split calculator india reverse stock split calculator NSE stock split calculator BSE stock split calculator. Web Stock Split Ratio. Web A stock split calculator is simply a calculator that will help you to calculate how much your stock is now worth after the company has initiated the stock split.

Web This calculates the earnings per share considering the impact of the reverse stock split. The typical math in a reverse stock split is performed by a companys brokerage firm. Web The math is quite simple but can sometimes end in fraction shares.

8 and the normal range is 2 It contains tab-delimited values As you can see from image1 For. Divide the number of shares you own by the second number in the ratio. The total amount of people is provided as.

The current share price. The net income appears near the bottom of the statement. Payable date of stock split mmddyyyy 4.

For example if a company. Web Common share swap ratios used in a reverse stock split are 12 1-for-2 110 150 and even 1100. Finally calculate the Reverse Split.

Reverse Stock Split What It Is What You Should Know Stockstotrade

Stock Split And Reverse Stock Split Definition Examples And Top Companies Splits

What Does Google S 20 For 1 Stock Split Mean Personal Finance Club

Reverse Stock Split Formula And General Electric Ge Example

Reverse Stock Split Formula And General Electric Ge Example

Reverse Stock Split Formula And General Electric Ge Example

Stock Split And Reverse Stock Split Definition Examples And Top Companies Splits

Stock Splits Financial Edge

The Effect Of Stock Splits On Adjusted Cost Base Adjusted Cost Base Ca Blog

Forward Stock Splits Vs Reverse Stock Splits Stock Trading 101 Youtube

Bonus Shares And Stock Split The Concept Formula And Examples Getmoneyrich

Reverse Stock Split Calculator Calculator Academy

Stock Total Return And Dividend Calculator

Example Of Stock Split India Ratio Forward Calculation

Reverse Stock Split Meaning Example How It Works

Reverse Stock Split Calculator Calculator Academy

Stock Splits Financial Edge